Compound interest with withdrawals formula

For the year the bond would have. The formula for compound.

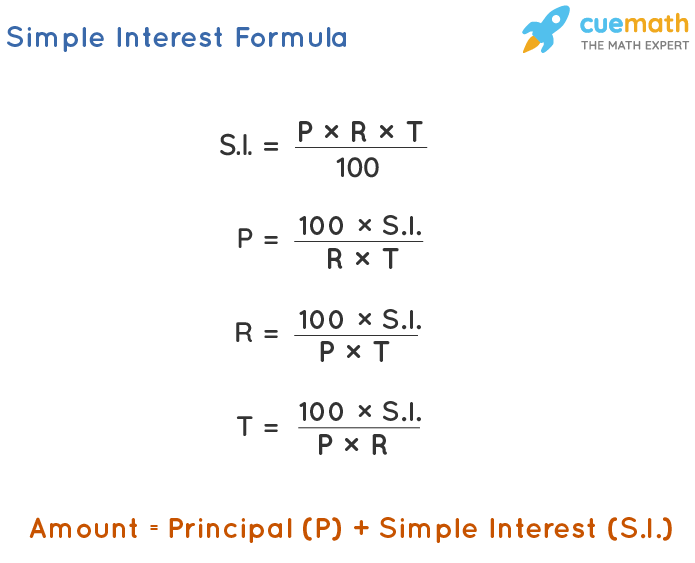

Simple Interest Definition Formula Examples Faqs

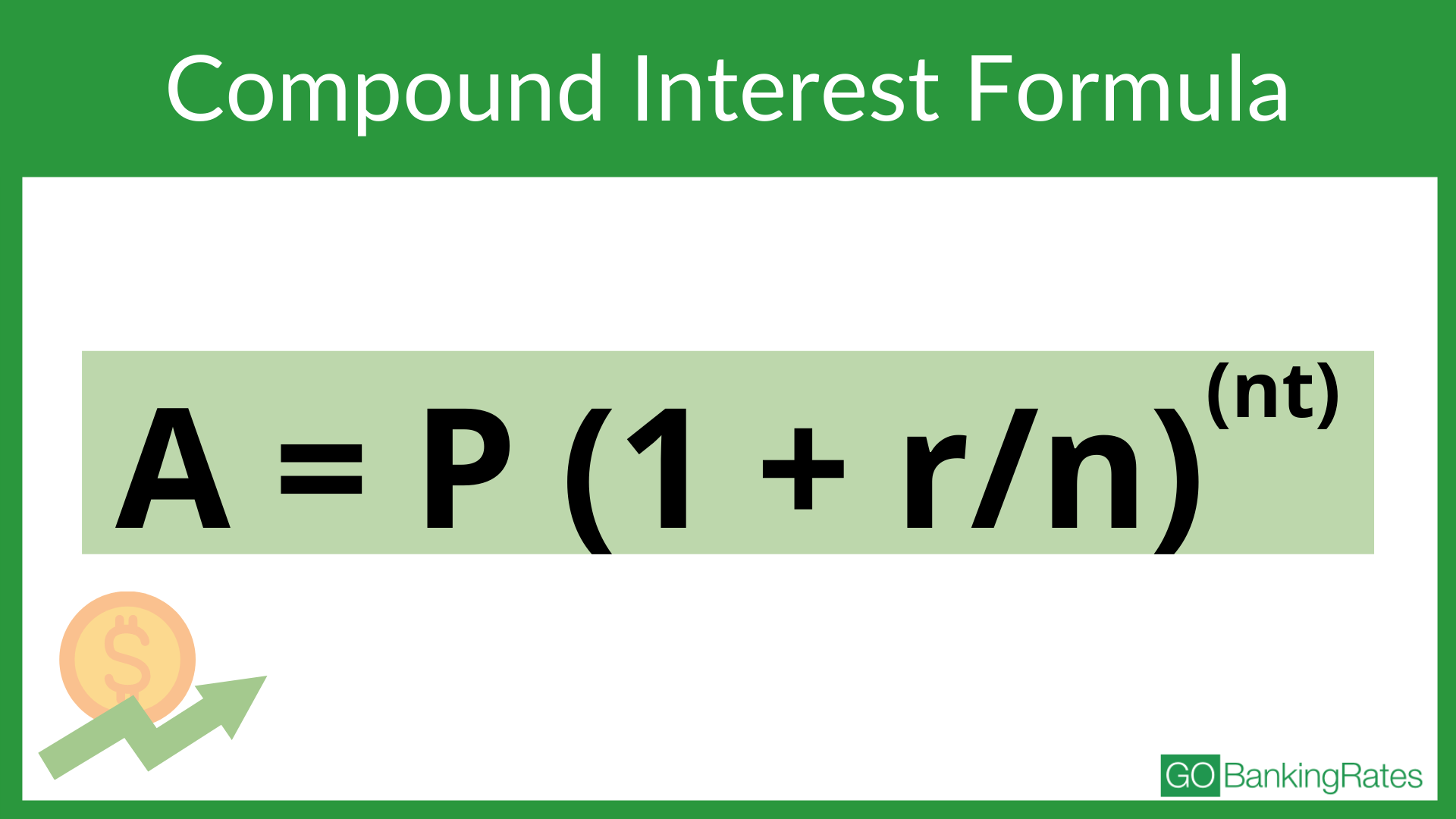

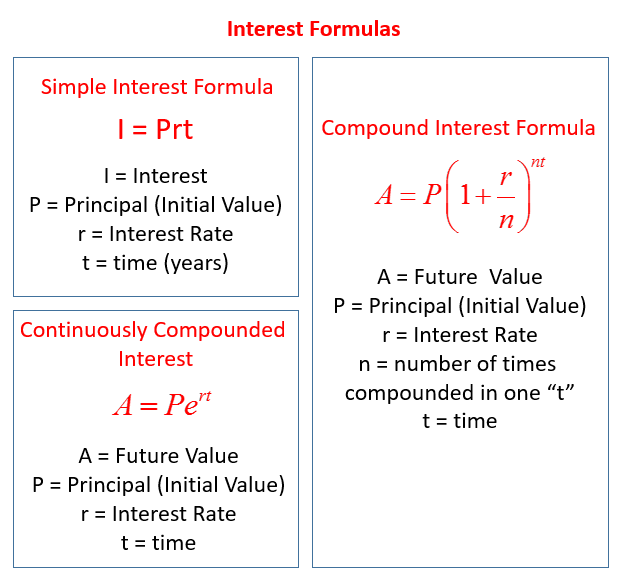

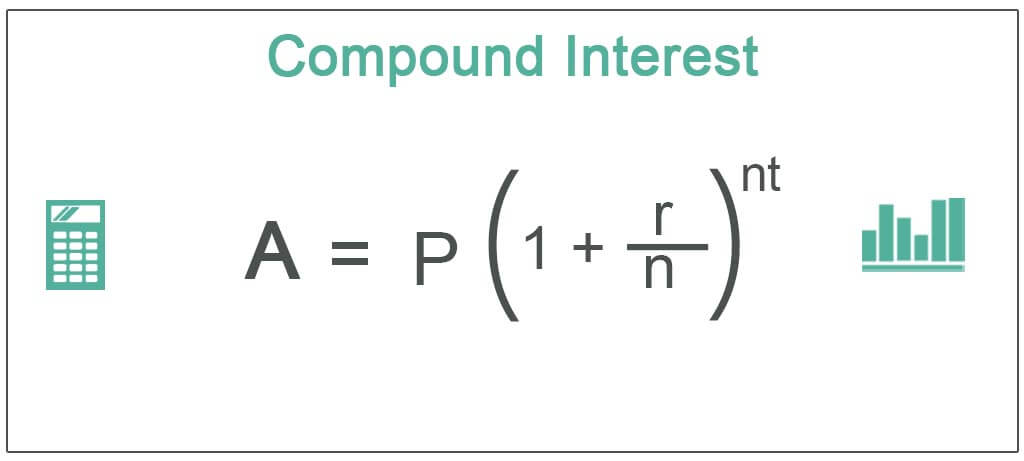

Compound interest is calculated using the compound interest formula.

. A the future value or FV of the investmentloan including interest. Compound interest or interest on interest is calculated using the compound interest formula. I think by interest rate on savings he means any investment return not necessarily the interest rate on a savings account in a bank.

Our simple savings calculator helps you project the growth and future value of your money over time. Include any regular monthly quarterly or yearly deposits or withdrawals. This compounding interest calculator shows how compounding can boost your savings over time.

A Ending amount. Want to see how much you interest you can earn. Compound interest includes interest earned on the interest that was previously accumulated.

The interest paid on this bond would be 30 per year. Use the formula AP1rnnt where. The time value of money is the widely accepted conjecture that there is greater benefit to receiving a sum of money now rather than an identical sum later.

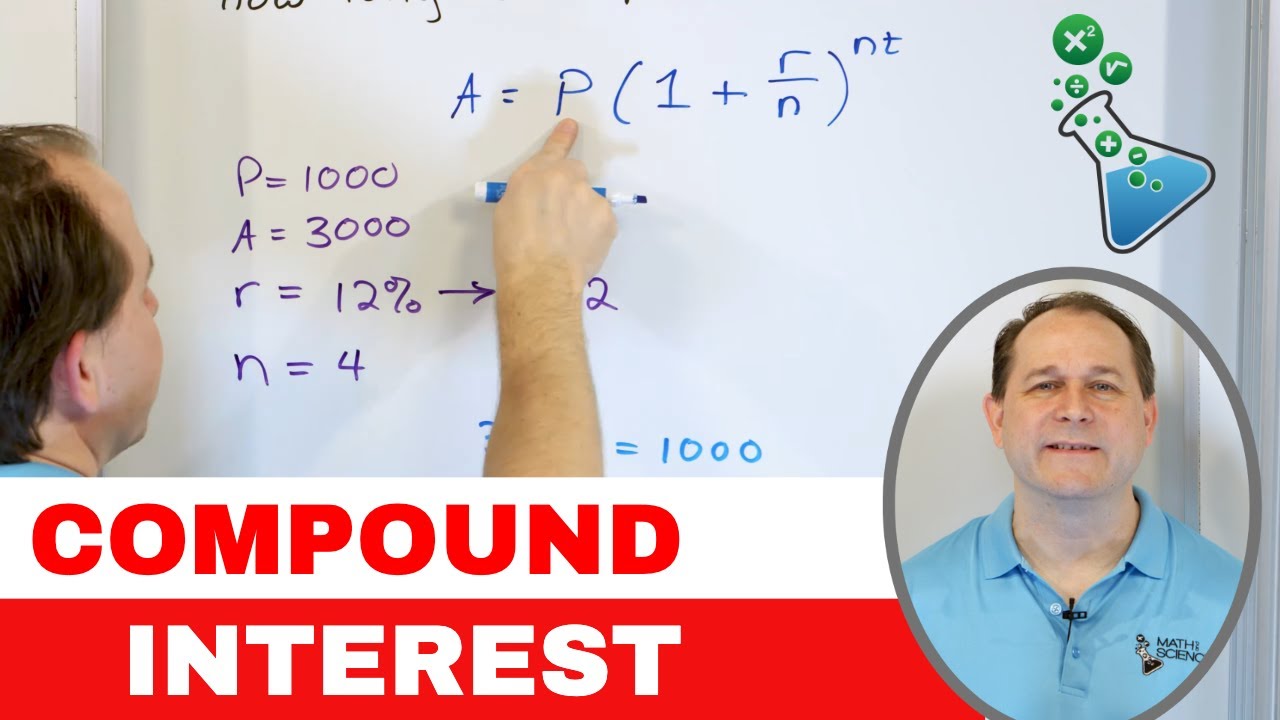

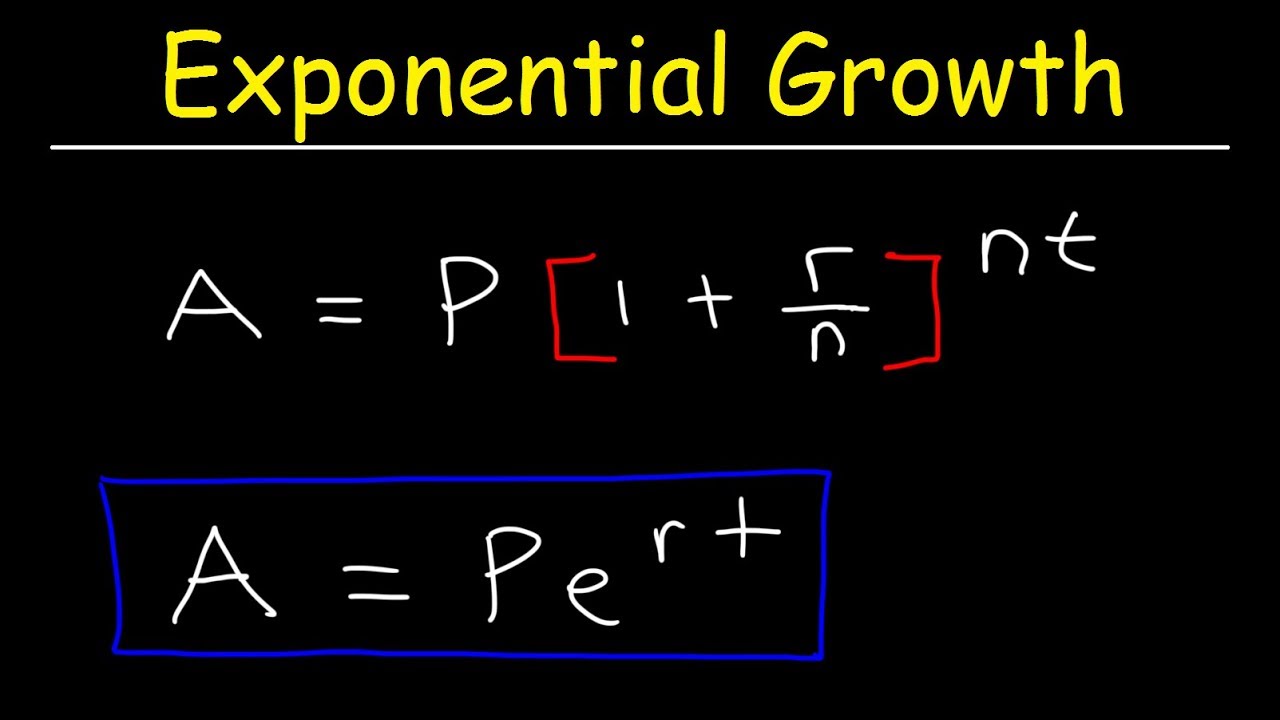

The compound interest formula is the way that compound interest is determined. Lets go over the compound interest formula and define each of the variables. To calculate your future value multiply your initial balance by one plus the annual interest rate raised to the power of the number of compound periods.

Compound interest or interest on interest is determined using the formula C I P 1 r 100 k k n P where P is principal r is the annual rate of interest in percentage k is the number of compounding periods per year and n is the number of years. In many cases homeowners can earn more by investing their money than by making additional mortgage payments. If you plug in 4 youll get numbers close to what you have in the table above.

In other words the results of what you can achieve through the magic of. A ending amount this means original balance plus. R the annual interest rate expressed in decimal form decimal 100.

Not Your Fathers Catalog Music Streaming has made catalog music more important than ever - but the catalog thats growing isnt necessarily what youd expect. P1 RNNT A. The time value of money is among the factors considered when weighing the opportunity costs of spending rather than saving or investing.

It is valuable to lenders because it represents additional income earned on money lent. Compound interest formula. Compound Daily Interest Calculator.

How to avoid early withdrawals. A P1 rnnt where. With simple interest the balance on that bond would have been 23250 on the maturity date.

R is also known as rate of return. Heres how to compute monthly compound interest for 12 months. When you enter an annual interest rate it calculates the future value of annuity but it can be used for monthly daily quarterly etc.

The progressive benefit formula for Social Security is blind to the income a worker may have from non-wage sources such as spousal support dividends and interest or rental income. Finally people who derive a high percentage of income from non-wage sources get high Social Security net benefits because they appear to be poor when they are not. It uses the compound interest formula giving options for daily weekly monthly quarterly half yearly and yearly compoundingIf you want to know the compound interval for your savings account or investment you should be able to find out by.

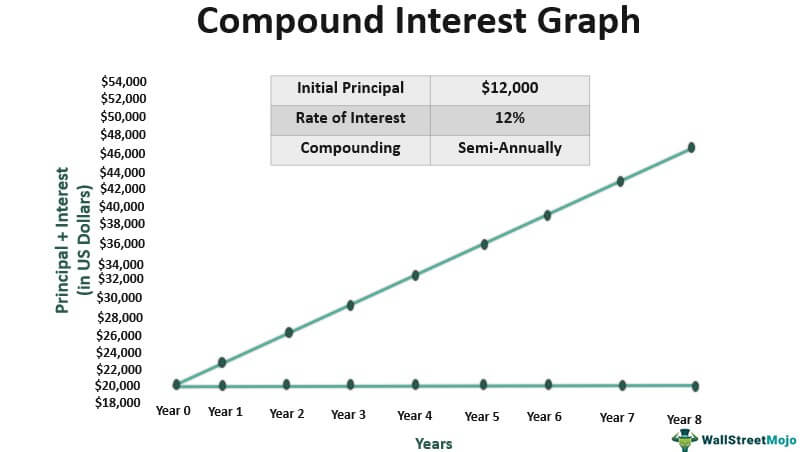

While this may not seem like much once we increase the variable of the years of the 20000 compound interest investment we would see a balance of 98977 in 50 years compared to just 52500 with simple interest. You can use the results as a guide to create. Compound interest is valuable for those who make deposits because it is an additional income for them the longer the deposit sits without withdrawals.

P is the investment or principal balance at the start of. A P 1 r n nt. How to calculate your savings growth.

The formula for compound interest is A P1 rnnt where P is the principal balance r is the interest rate n is the number of times interest is compounded per time period and t is the number of time periods. Get 247 customer support help when you place a homework help service order with us. Future Value calculation example Let us assume a 100000 investment with a known annual interest rate of 14 from which one wants to withdraw 5000 at the end of each annual period.

The more interest you will earn over time. If youd prefer to try your hand at calculating interest without a calculator use the compound interest formula. Deriving Compound Interest.

The Joint Standing Committee on Commerce Industry and Banking JSCCIB on Wednesday pleaded with the Thai government to raise electricity bills wages and interest rates gradually in order to mitigate the negative impact of the Covid-19 pandemic on businesses. Compound interest is a powerful force for people who want to build their savings. Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Interest rates are currently at historic lows. N the number compounding periods per year n 1 for annually n 12 for monthly etc.

Compare for example a bond paying 6 percent semiannually that is coupons of 3 percent twice a year with a certificate of deposit that pays 6 percent interest once a yearThe total interest payment is 6 per 100 par value in both cases but the holder of the semiannual bond receives. Now lets put those in the compound interest formula. That includes your 5000.

Deposits and withdrawals. It may be seen as an implication of the later-developed concept of time preference. P Principal amount the beginning balance.

You can calculate based on daily monthly or yearly. Dont give up a low interest rate. Although it is easier to use online daily compound interest calculators all investors should be familiar with the formula because it can help you visualize investing goals and motivate you in terms of planning as well as execution.

Ln50 004 17329 years to retire at 50 savings rate ln80 004 55786 years to retire at 80 savings rate. In 10 years youd have about 8238 in the account. Thought to have.

If the investor sells the bond after one years at a value of 1100 it will result in a 100 gain. We start with A which is your investment horizon or goal. P the principal investment amount the initial deposit or loan amount also known as present value or PV.

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

Compound Interest Explained With Calculations And Examples

What Is Compound Interest A Guide To Making It Work For You Not Against You Gobankingrates

Compound Interest Calculator Daily Monthly Quarterly Annual

Pin On Excel Tips

26 Compound Interest Formula Exponential Growth Of Money Part 1 Calculate Compound Interest Youtube

:max_bytes(150000):strip_icc()/dotdash_INV_final-Stated-Annual-Interest-Rate_2021-01-b21e3142ad46439fa021c4ce978baa68.jpg)

Stated Annual Interest Rate Definition

Simple Interest Formula Video Lessons Examples And Solutions

Compound Interest Definition Formula Calculation Invest

Compound Interest Formula Explained Investment Monthly Continuously Word Problems Algebra Youtube

Compound Interest Formula Explained Investment Monthly Continuously Word Problems Algebra Youtube

/Compoundinterest-f0b145415f244b40bb93c82154e8343d.png)

Compound Interest Explained With Calculations And Examples

Openalgebra Com Interest Problems

Compound Interest Definition Formula Calculation Invest

Compound Interest Calculator With Formula

Compound Interest Example Withdrawal Case Youtube

How To Find Or Calculate The Principal In Compound Interest Formula For Principal In Interest Youtube

Compound Interest Dealing With Multiple Deposits Or Withdrawals Sample Problems Youtube